This article by Gigi was published on dergigi.com website.

An open letter to the confused and dismissive.

It should be obvious by now, but I’m afraid I’ll have to spell it out anyway: Bitcoin, not blockchain. Bitcoin, not crypto. Bitcoin, not distributed ledger technology. Bitcoin, not DeFi. Bitcoin, not Web3. Bitcoin, not CBDCs. Bitcoin, not yield farming. Bitcoin, not centralized neo-banks that sell you fractional-reserve paper bitcoin. Bitcoin.

If you think that Bitcoin is dead, you’ve been fooled by fiat journalists. If you think that Bitcoin is slow, or old tech, or MySpace, or the Model T, you’ve been fooled by snake-oil salesmen.

In the former case, you are probably feeling smug: “I knew that it was all a Ponzi scheme! Good thing I didn’t invest in bitcoin. I told ya’ll that it will go to zero!”

In the latter case, you are probably still in shock because the likelihood is high that you just lost all your money. Maybe you are still in denial. Maybe you are angry or even depressed. Maybe your pre-mined world-computer coins are locked up in a centrally controlled staking system, and you have no way of getting them out again 1. Unfortunately, there is no way to fast-track the five stages of grief. You have to slouch through it all until you finally arrive at acceptance: “I never had bitcoin in the first place, I only had IOUs and paper bitcoin. I was the yield that was being farmed.”

Admitting that you’ve been fooled is one of the hardest things there is. It takes humility, strength, self-reflection, and the swallowing of pride to acknowledge that you’ve been had. It’s easier to blame someone else and double down—or to throw your hands in the air and walk away. It’s a harsh truth, and at some point in the future, you will be able to hear it:

You have been fooled, and you have no one to blame but yourself.

If that’s too painful right now, fine. Step back. Do something else for a while. Spend some time with your family, or in the woods, or go fishing or something. And once you come back, try to wrap your head around the following: Bitcoin is the signal, and the rest is noise. All of it.

Bitcoin is the signal.

I am not writing this to kick you while you’re down. I am writing this because I believe that nobody is beyond redemption. I am writing this in the hopes that some of you, dear crypto bros, will only have to touch the shitcoin stove once. I am writing this in the hopes that some of you, dear fiat bros, will finally understand that bitcoin is not only different from all of “crypto,” but that it is different from all other currencies, your beloved government-issued shitcoins included. My message to you is the same:

There Is Bitcoin, and There’s Everything Else #

You have to understand that Bitcoin is not an app, or a company, or a stock, or an investment. Bitcoin doesn’t have a board of directors, or a CEO, or quarterly earnings. There is nobody “behind” Bitcoin.

Many bitcoiners have strong opinions when it comes to bitcoin vs. “crypto”—and for good reason. One is a breakthrough of enormous proportions. The others are cheap imitations, copy-cats that have been riding the coattails of said breakthrough for way too long, confusing noobs and retail investors alike. “Crypto” is nerds re-discovering money printing and pyramid schemes. Seemingly free lunches propped up by perpetual motion machines that run on technobabble.

Crypto does not compare to Bitcoin. If you want to compare Bitcoin to something else, compare it to fire, the number zero, the wheel, the printing press, or electricity. Yes, it is that important. It is an autopoietic network that is internally stable and can’t go bankrupt. The antidote to the corruption of money.

It is an entirely new thing, something that is so profound, so alien, so novel that most people fail to appreciate it. I don’t blame them. Most people know nothing about cryptography, or networks, or money, or open protocols. Consequently, most people are easily fooled.

What is so revolutionary about bitcoin?

- Bitcoin is absolutely scarce

- Bitcoin’s issuance is fixed in time

- Bitcoin can be stored in your head

- Bitcoin can be sent at the speed of light

- Bitcoin can be verified by anyone, easily and cheaply

Every single one of these points is revolutionary in itself.

We never had a liquid asset that is absolutely scarce. We never had a man-made currency that didn’t have an issuer. We never had a marketable good that was just words, something that still blows my mind to this day: learn 12 words by heart, and you can flee your country with your wealth intact. We never had high-velocity money without having to rely on credit.

Allow me to repeat the last point for emphasis: for the first time in human history, we have a money that is pure information—something that stores value in bits and bytes directly, without having to rely on a trusted third party—and because it is pure information, it can be sent to anyone at the speed of light.

Unfortunately, this killer feature of bitcoin is lost on most people: Bitcoin is not credit. It’s not an IOU. Not a promise. Not reliant on any counterparty. Not a liability. Like gold before it, it is not backed by anything. It is the desirable thing itself. It is money. Pure, un-debaseable money.

Whether you’re a rekt crypto bro or a friend of fiat, there is one thing that is especially difficult to accept. The one thing that sets Bitcoin apart: it all works without anyone in charge.

Bitcoin is best understood as a force of nature, like the coming and going of the tide, like the sun rising in the east and setting in the west. You can have an opinion on it, but your opinion doesn’t have any influence on the phenomenon whatsoever. The tide will come and go, the sun will rise and set, and Bitcoin will produce a new block. Every 10 minutes.

“Amidst attention-grabbing headlines this week that will be talked about for decades, I want to bring your attention to one far more profound and awe-inspiring non-headline: every 10 minutes a new bitcoin block was produced. Every 10 minutes. Every 10 minutes.”

Source: bitfeed.live

Bitcoin just works. Like clockwork. It works because you don’t have to trust anyone. It works because it uses mathematics and physics—the laws of nature—to remove any trust from the system. It works because you can verify anything yourself. It works because it is not an external thing (dictated by someone else) but an emergent thing: brought into existence by relentless validation and verification. It works because you and only you are in charge.

If you aren’t in charge, you are not using bitcoin. You are trusting someone else with their interpretation of Bitcoin—or, even worse—you are trusting someone else to hold bitcoin for you.

“The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve. We have to trust them with our privacy, trust them not to let identity thieves drain our accounts.”

Bitcoin was created as a response to the rug-pulls of the fiat world. It is anti-rug-pull technology. But it is only anti-rug-pull technology if you use it right: your node, your rules, your keys, your bitcoin.

Crypto, on the other hand, is fiat on steroids. Worse, it is fiat on methamphetamines. It is the belief that honest money doesn’t matter, which is why every project, every person, every exchange, every network, every system, every community, and every jpg needs its own separate form of money. It’s economic nihilism.

The two couldn’t be more different. Bitcoin removes seigniorage. Shitcoins re-introduce seigniorage. Bitcoin removes the Cantillon effect. Shitcoins re-introduce the Cantillon effect. Bitcoin removes trust. Shitcoins re-introduce trust. As do centralized financial services motivated by fiat thinking.

But Isn’t Bitcoin Dead? #

No, it’s not dead. It’s also not a fad, or suddenly useless, or suddenly worthless. What happened is what always happens: people get complacent, people get greedy, and people fool themselves and others.

By layering trust on top of Bitcoin, you re-introduce central points of failure and systemic risk—for any systems built on top of these central institutions, that is 2. This has happened before, and it will happen again. Time is a flat circle.

| Entity | BTC Lost |

|---|---|

| Bitcoinica | 61,000 |

| Bitfloor | 24,000 |

| MTGOX | 650,000 |

| Cryptsy | 10,000 |

| Bitstamp | 19,000 |

| BTC-e | 66,000 |

| Bitfinex | 120,000 |

| QuadrigaCX | 10,000 |

| Cred | 10,000 |

| Fcoin | 10,000 |

| Celsius | 105,000 |

| BlockFi | 30,000? |

| Voyager | 10,000? |

| FTX | 70,000 |

Source: Jameson Lopp 3

Again, a centralized company failed. Again, it is unclear how much of this failure was due to incompetence, how much due to malice, and how much due to fraud. Again, the Bitcoin network was unaffected. Again, people relied on trust. Again, the rug was pulled.

It should be obvious by now that bitcoin held by someone else is not your bitcoin. It should be obvious that paper bitcoin is not bitcoin. Further, it should be obvious that bitcoin and leverage mix as well as oil and water.

All of this has happened before. And, human nature being what it is, all of this will happen again. People will—again—fail to heed the warnings of the more experienced bitcoiners. People will—again—fail to hold their own keys. People will—again—fall victim to the Siren songs of more gains, more yield, fast riches, and easy money.

“A fool and their leveraged bitcoin are soon parted.”

And when the fools once again lose all their money; and when you, dear crypto bros, get rug-pulled by your dear leader; and when you, dear fiat bros, declare Bitcoin dead once more; and when the 500th bitcoin obituary has been written; Bitcoin will still march on, unhindered.

But What about the Price? Didn’t It Crash? #

Yes, it did crash. And it will crash again, and again, and again. Like it has in the past.

As of this writing, the bitcoin price is 16,641 USD. Yes, it went all the way to $65,000, and then it crashed all the way down to $16,000.

Here is what you have to understand: USD price is both important and unimportant.

Here is how price is important: BTC needs to have a price so that the Bitcoin system can secure itself. Price is correlated to hashrate (which is again correlated with security or, more accurately: settlement assurance). It is also a good indicator of global adoption. And yes, we usually use USD to measure the BTC price because, as of this writing, USD is still the unit of account of this world. Sadly.

To see how price is unimportant, let’s ask some questions and answer them one by one:

- Did the BTC supply change? No.

- Did the network stop? No.

- Can you still send sats to anyone without having to ask for permission? Yes.

- Do holders still hold the same amount of BTC? Yes.

- Can you still easily and cheaply verify all of the above? Yes.

From the point of view of the Bitcoin network, nothing changed.

In other words: the rules of the network did not change. Supply is still limited. Every 10 minutes, new transactions are settled. The monetary policy did not change. The properties of the asset did not change. One BTC still equals one BTC.

Bitcoin worked just as well as it does now when the USD price was zero, which was the case for the first ten months of its existence. Without a central issuer, bitcoin had and still has to grow organically in value, distribution, and security, which is why many people — myself included — believe that Bitcoin’s history can not be repeated, i.e., that a scarce digital commodity is path-dependent.

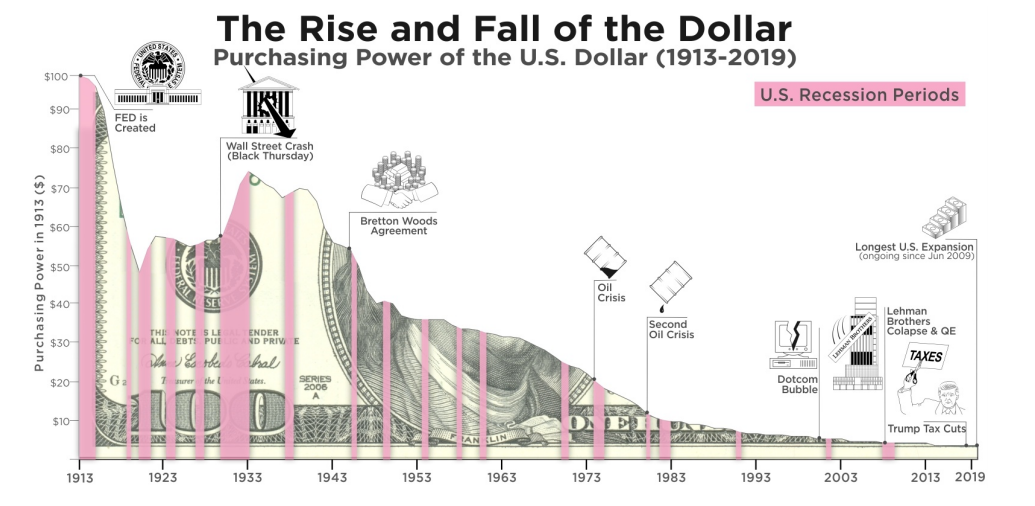

Speaking of price: it helps to put things in a broader context when talking about any price in the first place. Nominal price is an expression of relationship, and thus any price depends on the unit you use to measure said price. The economic lens that you use to see through and see the world with.

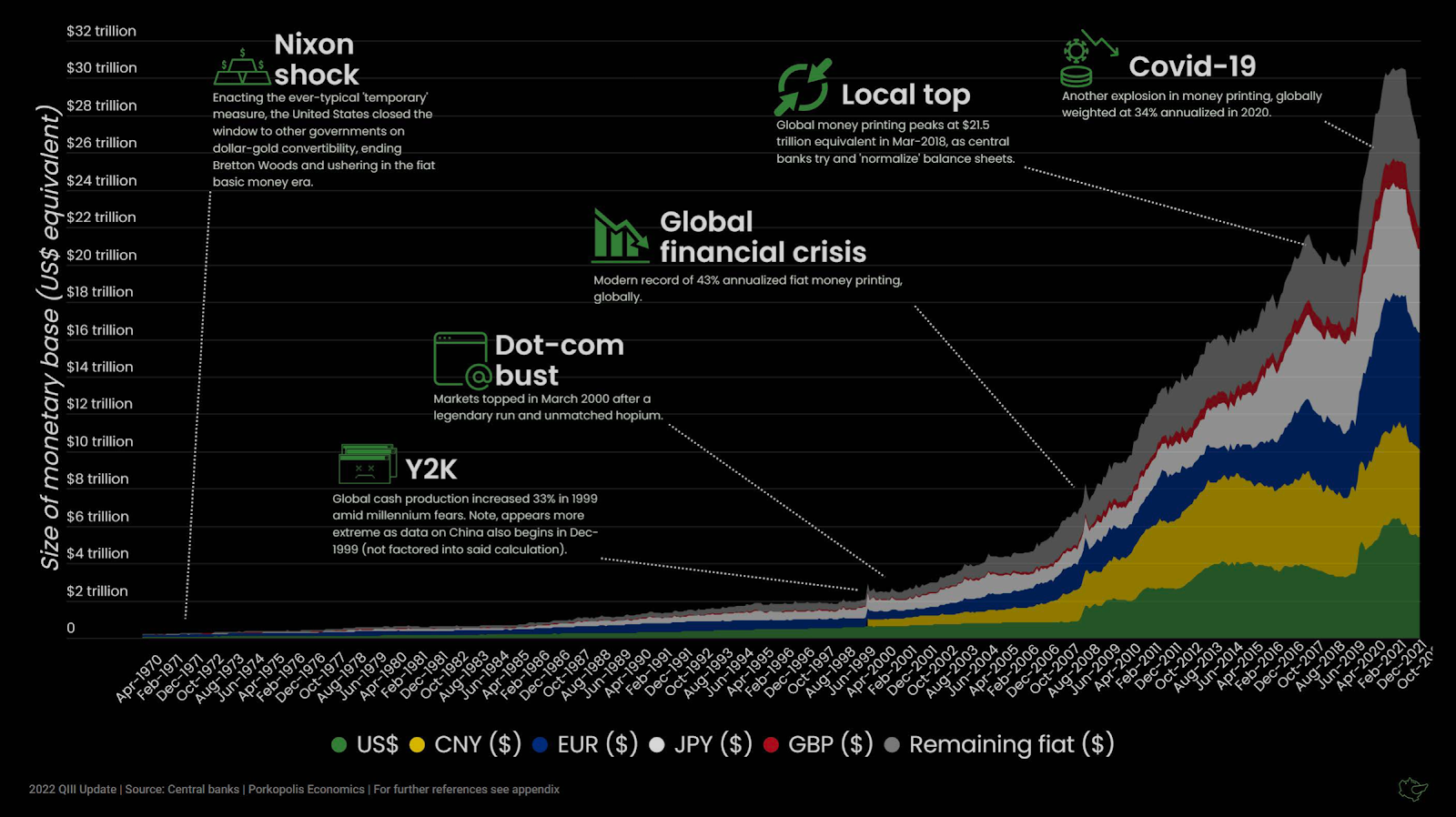

It is worth noting, for example, that the USD M2 money supply has expanded massively in the last couple of decades. The most recent expansion of over 30% was in large part due to the monetary response to the worldwide lockdowns. In other words: when measuring the value of things in USD, everything is distorted by at least 30%.

Shitcoin printer go BRRR (Source: Porkopolis)

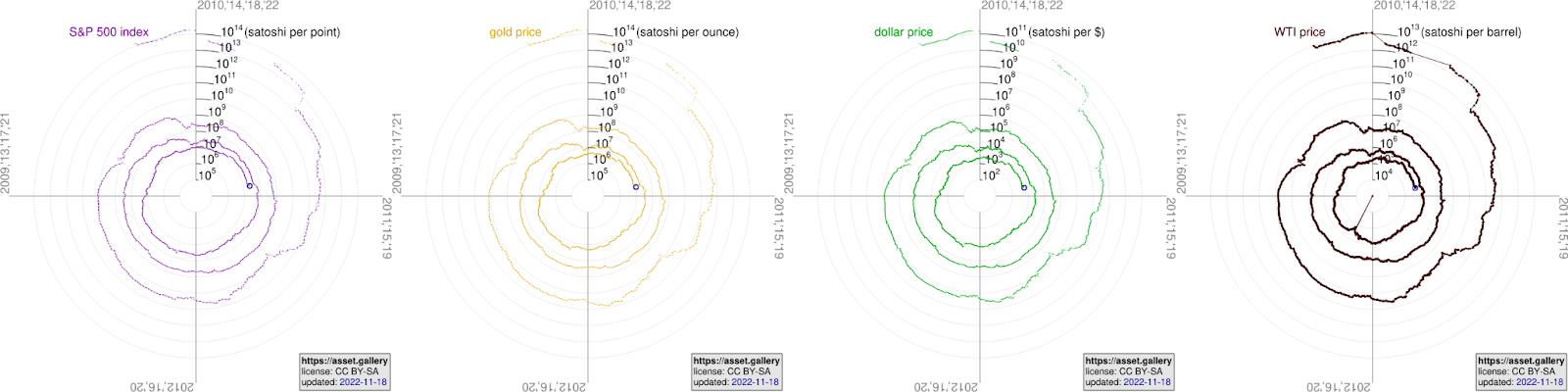

When it comes to economic views, we see with and through the respective currency we are forced to do economic calculations with. Whether our default lens is the USD, the EUR, or the YEN, depends mostly on circumstance and geography. Granted, BTC is not universally useful as a lens yet, but it is useful as a comparison to fiat lenses. It is useful because it provides a counter-balance to the inflationary monetary policies of fiat currencies. It is useful because, from a BTC point of view, it shows that everything is being repriced in sats. Even the stupid shit you bought a couple of years ago.

Some lenses are more useful than others.

Consequently, bitcoiners like to speak of purchasing power because it is irrespective of the nominal value bound to fiat currency measure. Note, for example, that the BTC chart looks very different depending on what you use as measurement, whether its USD (United States dollar), ARS (Argentine peso), NGN (Nigerian naira), VED (Venezuelan bolívar), or — to pick something else entirely — the S&P 500, gold, or barrels of oil.

In the western world, we are especially oblivious to the fiat lens through which we view the world. We are mostly dealing with “stable” currencies, i.e., currencies that are slowly declining in purchasing power. But make no mistake: all fiat currencies are inflating. If money can be printed, it will be printed. The temptation is simply too strong.

Consequently, all fiat monies are monies of decline. And if this decline happens too quickly—When Money Dies — the distortion in prices becomes obvious. And if the distortion gets big enough, all long-term economic calculation — and with it, regular life — breaks down.

Do you think it rose substantially from 2019 to 2022?

The above charts show two things clearly: fiat currencies are designed to lose purchasing power over time. Bitcoin is designed to monetize naturally over time, and, all things being equal, it will continue to monetize.

It will continue to monetize because bitcoin is valuable. It is your money. Nobody can interfere with it. Nobody can debase it. Nobody can take it from you (when stored properly, that is). Nobody can stop you from using it. In a world of de-platforming, de-banking, and CBDCs, having censorship-resistant, unconfiscatable money is valuable in itself. If you disagree with the above, I invite you to Check Your Financial Privilege.

Currently, BTC is ranked #28 worldwide, both as an asset and when compared to fiat currencies. It is #28 now because it crashed, and it crashed because people are greedy, over-leveraged, and there are no bailouts. It seems, however, that despite all of this, bitcoin is continually monetizing.

Due to bitcoin’s fixed issuance schedule—its predetermined issuance over time—the only thing that can meaningfully respond to adoption waves is price. How else could an asset monetize naturally—an asset that doesn’t have an issuer—but chaotically? Or, to quote Allen Farrington:

“What would it seem like if it did seem like a global, digital, sound, open source, programmable money was monetizing from absolute zero?”

But Bitcoin Doesn’t Produce Anything! #

Wrong. Every 10 minutes, a new valid block is produced. That’s all that matters. And with this block, another chapter of unforgeable history is being written, and the core promise of Bitcoin is kept: “I will not steal from you.” Neither through debasement nor confiscation.

If you think that bitcoin should produce anything else—like yield, for example—you are still looking at the world through a fiat lens. Bound to the view that you have to “put your money to work.” You did not pause and reconsider the yield from money held.

I empathize with you. I was looking at the world through the same fiat lens not too long ago. I was even bullish on “crypto,” believing that an unstoppable world computer would be a neat thing. It took me a very long time to understand that printing money does not enrich society, but does just the opposite.

In the same way, it took me a very long time to step back and ask myself the following questions, almost like a child: “Why does your hypothetical world computer need its own currency? Why does your company need its own currency? Why does your centralized exchange need its own currency? Why do you need to print your own money for your endeavor to be successful?”

I used to be a crypto bro myself, and it was the difficulty I had when trying to answer these questions truthfully that turned me away from “crypto” and towards bitcoin. And when I was a fiat bro, I didn’t even know these questions were worth asking in the first place.

The most difficult thing is to get rid of the fiat mindset, which is to say to step back and ask yourself very simple questions about money: why do we have it, why do we need it, why does it have to be scarce, why can some people print it while most have to work for it, and so on. These are hard questions. Those who run the money printers don’t want you to ask, “WTF happened in 1971?” Those who run the shitcoin casinos don’t want you to ask, “but where does the yield come from?”

BUT WHERE DOES THE YIELD COME FROM?

But even with all the shenanigans that are currently going on, I’m hopeful. After all, “you can fool some people sometimes, but you can’t fool all the people all the time 4.” More and more people will learn. More and more people will hold their own keys. More and more people will run the numbers.

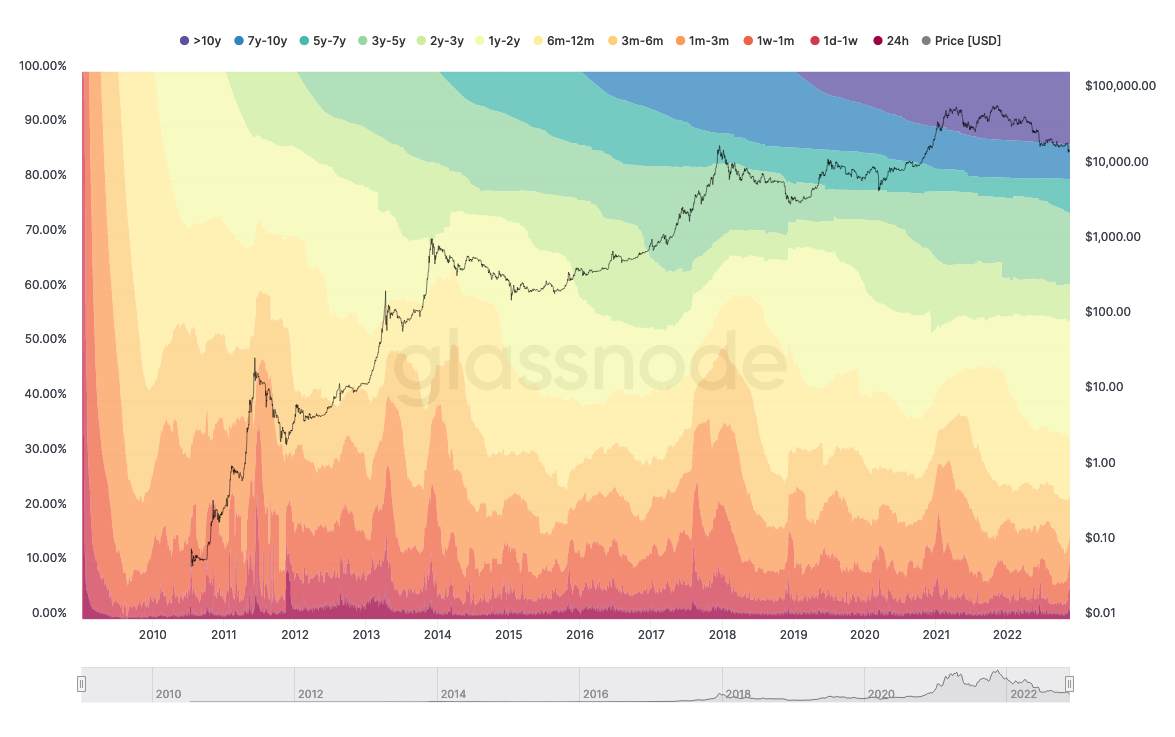

This assumption is not based on faith. Bitcoin’s on-chain data shows certain patterns, which I would summarise as “understanding increases conviction, conviction increases allocation”—or: the more you know, the more you buy.

~73% of sats have been held for more than a year

These “HODL Waves,” as they are called, show that an increasing number of people understand the underlying dynamics of, as well as the differences between, fiat monetary policy and Bitcoin’s monetary policy, which leads to them holding BTC on their personal or corporate balance sheets, rather than fiat currency 5.

But the Volatility! #

Volatility, volatility, volatility. All this talk about volatility misses the whole point of Bitcoin: deep, systemic stability.

Bitcoin isn’t volatile. Human psychology is.

Human behavior is volatile. Bitcoin isn’t. Consequently, bitcoin’s market price can be volatile. But Bitcoin is not. The Bitcoin network has been operating continually for well over a decade. It is predictable, steady, and reliable. From that perspective, Bitcoin is the most stable thing there is.

Every 10 minutes, a new block is found. Every 10 minutes, the whole system increases in reliability and stability, independent of price swings.

As long as new blocks are coming in, there is nothing to worry about. Once again, the lens you use to look at Bitcoin matters a great deal. Step back. Zoom out. Look at blocks, not price. Time, not yield. Base money, not credit.

But yes, while bitcoin is monetizing, swings in purchasing power are to be expected. The sensible response is to adjust your allocation according to your risk appetite. A 0% allocation is not a sensible position because a 0% allocation is a 100% allocation to assets that have substantial counterparty risk or, even worse, assets that aren’t assets in the first place — but liabilities.

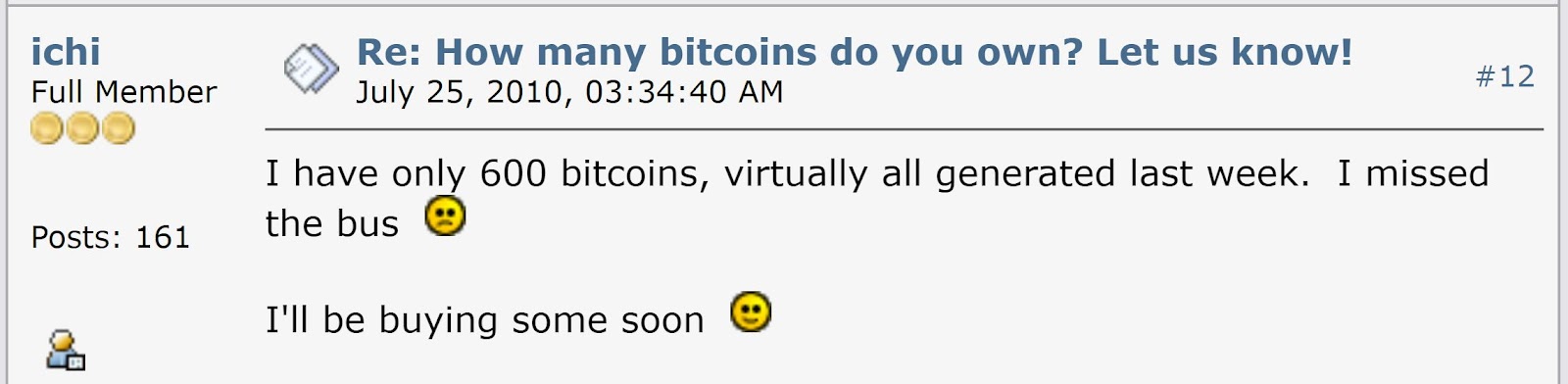

But I Missed the Bus! #

No, you didn’t. We are still very early in the unfolding of the bitcoinization process. Everyone thinks they are late. Everyone thinks that they have missed the bus.

Bitcoin is a hop-on hop-off bus, and round and round it goes.

Most bitcoiners don’t think of Bitcoin as an investment. It is a breakthrough technology that allows you to move wealth through space and time. It is not about getting rich in fiat terms. It is an exit, not a detour. It is about measuring your wealth in sats, not USD, or EUR, or any other random shitcoin. Your wealth. Held and controlled by you.

Because of this, it is never too late to use it to your advantage. Just like it’s never too late to adopt electricity or the internet. It is never too late to adopt the Bitcoin Standard.

But Bitcoiners Are Mean! #

Do the right thing. Drop your shitcoin bags, whether they are “crypto” or fiat-denominated. Start small. Take responsibility. Learn how to self-custody. Produce value, spend less than you make, and start saving in bitcoin. Start counting your wealth in sats.

Or don’t. You can also stay in crypto wonderland, buying ape JPGs and shares of Ponzis built on quicksand. You can once again believe all the lies of the next autistic wunderkind, convincing you that fundamentals don’t matter and that principles are worthless. You can also stay in the world of fiat slavery, believing that your money should steal from you (as long as the rate of stealing stays somewhere between 2-9%), that printing trillions out of thin air is sensible monetary policy, and that central-bank digital currencies are a neat idea.

In either case, Bitcoin doesn’t care. But when (not if) the next centralized abomination implodes, and when (not if) bitcoin reaches new heights again, and when the mainstream media screams “bubble” again, and when bitcoin’s price will once more correct after that, and when fools are once again parted with the coins that they thought they held, remember this: you could’ve known better. You could’ve held your own keys. You could’ve run your own node. You could’ve stayed humble. You could’ve stacked sats. You could’ve listened to the toxic maximalists. You could’ve read a book or two. You could’ve stayed away from the shitcoins, and the Ponzis, and the central points of failure. But you didn’t. And you have no one to blame but yourself.

Good luck.

Just look at this clusterfuck. Look at it! ↩︎

Securing bitcoin’s scarcity: fighting fake bitcoin by Jameson Lopp, Casa Blog ↩︎

“Crypto” has no monetary policy, so it’s not even worth mentioning. If you’re still curious, read Lyn Alden’s article or just look at one of these two images. ↩︎